Quan tâm đến danh sách 10 vận động viên bóng chuyền nổi tiếng suốt thời gian là vấn đề đối…

Bạn đam mê tự do phiêu lưu trong PUBG? Hãy khám phá cách tải bản đồ PUBG mới nhất và…

Khám phá cách mua thẻ đổi tên PUBG Mobile và tạo nên một danh tính mới, sành điệu trong thế…

Đã bao giờ bạn tò mò muốn khám phá cách thuê gái chơi PUBG để tạo thêm niềm vui và…

Tìm hiểu cách setting PUBG Mobile 2 ngón để nắm bắt quyền kiểm soát trò chơi một cách tốt nhất.…

Thách thức những giới hạn, vươn tới đỉnh cao với cách chơi PUBG mobile bản quốc tế trên PC! Hãy…

Bạn đang muốn biết cách update PUBG PC một cách nhanh chóng và dễ dàng? cách cập nhật PUBG trên…

Nếu bạn đang tìm hiểu về cách tải PUBG Mobile Lite cho Android, hãy tiếp tục đọc bài viết này.…

Muốn tải và bắt đầu chơi PUBG APK? Hãy theo dõi bài viết này để khám phá cách tải PUBG…

Bạn đã sẵn sàng khám phá cách chơi chế độ Zombie trong PUBG Mobile chưa? Cuối cùng, chế độ zombie…

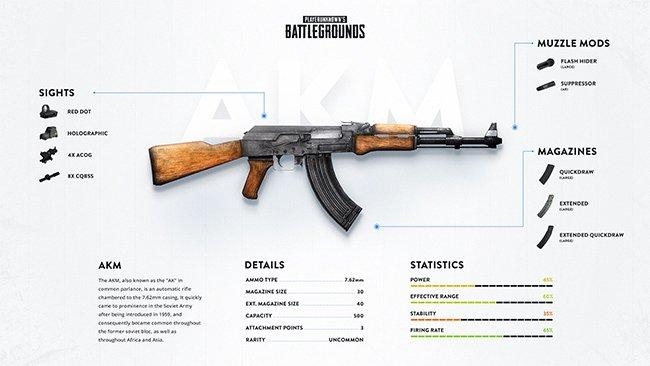

Bạn đã bao giờ tự hỏi cách bắn chuẩn trong PUBG để trở thành một chiến binh giỏi? Theo thống…

Bạn đã từng thắc mắc làm cách nào để có cách vào phòng trò chuyện PUBG và kiếm thẻ tạo…

Bạn muốn biết cách tải hack PUBG Mobile? Phiên bản mới nhất của Pubg Mobile đưa bạn vào trải nghiệm…

Bạn muốn tìm hiểu cách giảm ping PUBG Mobile PC hiệu quả? Đừng lo, hãy để iapeace.org chia sẻ với…

Bạn đang tìm cách like trong PUBG Mobile? Trong trò chơi này, không có tính năng like nhưng bạn có…

Bạn đã từng tự hỏi liệu cách chỉnh giọng trong PUBG Mobile có ảnh hưởng đến trải nghiệm chơi game…

Bạn muốn trở thành “ông trùm bầu trời” trong PUBG? Đến đây, iapeace.org sẽ bật mí cho bạn cách lái…

Khám phá cách Mod Skin Pubg Mobile để biến đổi giao diện với dễ dàng. Tự tay tạo ra những…

PUBG Mobile không còn là tựa game xa lạ đối với các game thủ trên thế giới nói chung và…

Chiến đấu và chinh phục chính là cốt lõi của PUBG Mobile. Tuy nhiên, Cách Làm Nhiệm Vụ Trong Pubg…

Những vấn đề và lỗi khi chơi PUBG Mobile trên PC có thể làm bạn quằn quại? Đừng lo, hãy…

Bạn đã bao giờ tự hỏi về khái niệm “nạp lậu” trong game Pubg Mobile? Bài viết này iapeace.org sẽ…

Chúng ta đã thấy nhiều người chơi mới phải cố gắng hàng giờ đồng hồ để thích nghi với vị…

Đầu năm 2018, tựa game hot Tencent PUBG Mobile đã được nhiều game thủ mong đợi chính thức ra mắt…

Bạn muốn biết cách tải PUBG Mobile Lite trên CH Play? Hãy tiếp tục đọc bài viết này để tìm…

Bạn muốn tìm hiểu cách ping hướng trong PUBG PC để tăng tính tương tác với đồng đội? Hãy cùng…

Tìm hiểu cách đổi tên Clan trong PUBG Mobile để thể hiện cái tôi của bạn và mang đến sự…

Cách khử răng cưa trong PUBG Mobile – bí quyết chiến thắng của các game thủ chuyên nghiệp. Trong thế…

Bạn đã bao giờ tò mò Cách Xem Lại Trận Đấu Trong Pubg Mobile chưa? Đúng vậy, xem lịch sử…

Bạn đã từng thắc mắc về cách nhận biểu cảm trong Pubg Mobile? Bài viết này sẽ khám phá và…

Bạn đã từng tò mò về cách quay video trong PUBG Mobile để lưu lại những pha chơi đỉnh cao…

Bạn muốn biết cách vẽ mũ 3 PUBG và cách vẽ người trong PUBG? Hãy đọc bài viết này để…

Cách lấy ID PUBG Mobile như thế nào là hiệu quả nhất? PUBG Mobile là một trong những trò chơi…

Cách cập nhật PUBG Mobile iOS dễ dàng nhất để khám phá thế giới game độc đáo! Tôi sẽ chia…

Cách tải Sever Test Pubg thực hiện như thế nào là đơn giản nhất? Trò chơi sinh tồn PUBG: PlayerUnknown’s…

PUBG Mobile được tạo ra dựa trên một tựa game rất nổi tiếng trong những năm gần đây. Tuy nhiên,…

Cách lập tài khoản PUBG Trung Quốc như thế nào? PUBG Mobile được coi là một trong những trò chơi…

Cách tải PUBG Mobile Hàn Quốc Android như thế nào là nhanh nhất? PUBG Mobile là một trong những tựa…

Bạn có tin, chỉ với vài kĩ thuật nhỏ, chúng ta hoàn toàn có thể kiểm soát hoặc thậm chí…

Bạn đang tò mò cách vào Discord PUBG? Hãy để tôi giúp bạn hiểu rõ hơn. Discord là một ứng…

Bạn muốn biết cách report pubg mobile? Hãy tham gia đọc bài viết này để tìm hiểu về cách bạn…

Nếu bạn không thích ở trong một nhóm bất kỳ của PUBG Mobile thì bạn có thể tìm cách thoát…

Bạn đã bao giờ tự hỏi cách chỉnh ping đồ trong PUBG Mobile chưa? Ping đồ trong PUBG Mobile là…

Bạn biết cách nhảy nhanh trong PUBG Mobile không? Nhảy nhanh là một kỹ năng quan trọng giúp bạn di…

Cách lên rank Chí Tôn PUBG Mobile như thế nào?? Điều này là điều mà nhiều game thủ PUBG Mobile…

Bạn đang cần tìm hiểu cách lấy lại acc PUBG Mobile đã bị mất? Vấn đề này có thể xảy…

Bạn muốn biết cách livestream PUBG Mobile trên YouTube sao cho hiệu quả? Livestream PUBG Mobile trên YouTube cho phép…

Cách có đồ trong PUBG Mobile là một chủ đề được quan tâm bởi rất nhiều người chơi. Người chơi…

Bạn đang gặp vấn đề khi chơi PUBG và đang tìm cách sửa lỗi PUBG? iapeace.org sẽ giúp bạn giải…

Cách hiện Ping trong PUBG Mobile là gì? Ping trong PUBG là thời gian mà gói dữ liệu mất đi…

Cách lấy lại acc PUBG bị ban là một vấn đề quan trọng đối với các game thủ. Để khôi…

Hungry Shark World là một trò chơi cá mập nối tiếp sự thành công của Hungry Shark Evolution trên thị…

eFootball PES 2023 là một trò chơi bóng đá tuyệt vời đưa bạn vào cuộc hành trình đến đỉnh cao…

Art of War: Legions đưa người chơi vào một thế giới với nhân vật được tạo thành từ các khối…

Dành cho những người chơi Blox Fruit, chắc chắn chẳng còn xa lạ gì với Code Blox Fruit. Đây là…

World of Tanks Blitz là một trò chơi hành động bắn súng đưa bạn vào trận chiến của những chiếc…

Sử dụng Script King Legacy là cách nhanh nhất để tạo lợi thế và nâng cấp nhân vật của bạn.…

GTA Vice City phiên bản APK dành cho Android được ra mắt trong kỷ nguyên kỷ niệm 10 năm của…

Phiên bản MOD Asphalt 8 (Vô hạn tiền, Mua sắm) mới nhất 2023 sẽ cho phép bạn mua sắm miễn…

Bạn đã cảm thấy chán với các trò chơi đua xe, bắn súng hoặc giải đố? Hãy thử sức ngay…